Session Volume Profile

Unlike time-based indicators, SVP focuses on volume distribution by price, giving you insight into where buyers and sellers are most active.

Used by: J.P. Morgan, Morgan Stanley, RBC Capital Market, Jane Street, BlackRock

[1] J.P. Morgan U.S. Quarterly Summary

[2] Morgan Stanley’s U.S. Cash Equity Order Handling & Routing Practice

[3] RBC Capital Markets Aiden® Arrival Announcement

[4] ETF Execution Strategies — A study note on Jane Street’s Report

[5] BlackRock Global Perspective White Paper

To understand why Session Volume Profile (SVP) is such a powerful tool, you need to first dive into a popular strategy called order flow trading. This approach focuses on tracking real-time buying and selling activity—especially from large financial institutions. By analyzing where big orders are placed or executed, order flow traders can spot key levels of support and resistance long before retail traders even notice.

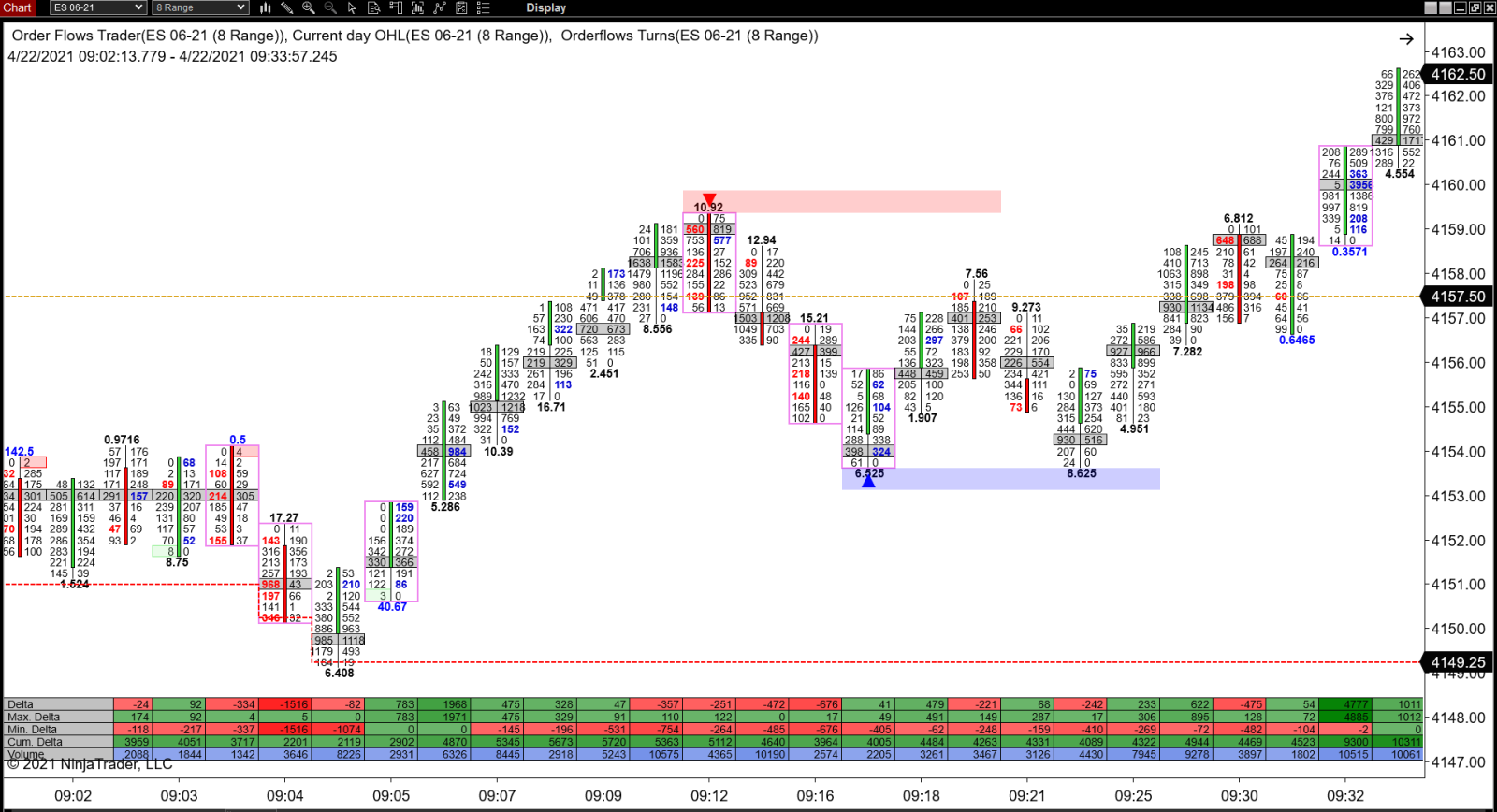

Take the order flow chart above, it highlights massive institutional orders stacking up, forming a clear resistance zone. That’s not a coincidence—it’s intent. In SVP, the mean usually aligns with the Point of Control (POC)—the price level with the highest traded volume during the session. This is the market's equilibrium, the level where buyers and sellers reached temporary agreement. Around this point, you’ll often see a smooth bell-shaped curve of volume distribution, and price tends to chop or stall here. No one's panicking, no one's rushing—it's just balance.

But the magic of SVP lies not in the center of that bell curve—but in the edges, where volume drops off sharply. These are the low-volume nodes, the “blank spaces” of price history. And ironically, these quiet zones are where the biggest explosions happen.

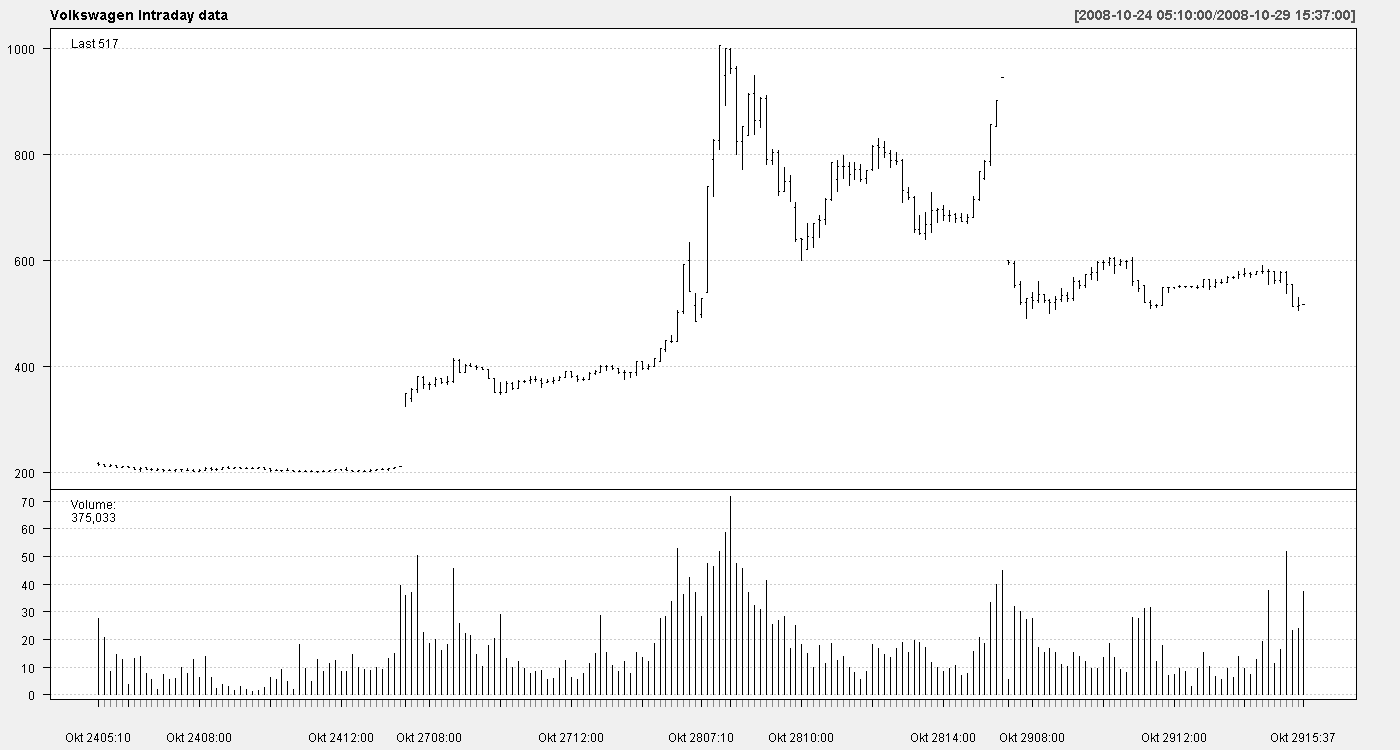

The 2008 Volkswagen short squeeze is a perfect example. Forced liquidations sent the price from €200 to over €1,000 in days. It wasn’t hype—it was shorts getting wiped out in a low-liquidity zone. Here's a step-by-step breakdown.

1. Price breaks above a high-volume area, moving into a low-volume node where very few trades have historically taken place. Liquidity here is thin—nobody’s really offering to sell up here.

2. That break triggers stop-losses from short sellers who had bet price would stay below resistance. These stops immediately turn into market buy orders—they need to close those short positions fast.

3. Because the volume is low in this zone, those buy orders can’t be absorbed easily. The order book is thin, so the market orders start eating through higher and higher ask prices, pushing price up fast.

4. As price continues to rise, more short sellers’ stop-losses are triggered. These also turn into market buys, stacking more demand into a thin part of the market.

5. Soon, price reaches the liquidation point for overleveraged short positions. At this point, exchanges force-close their trades by market buying, adding even more fuel to the fire.

6. This triggers more liquidations further up the chain. Each forced closure adds to the buying pressure, snowballing the move. Price can move violently, sometimes with zero pullback.

7. Eventually, the squeeze loses momentum—either by hitting a new high-volume area where sellers step in, or simply by exhausting all the weak shorts. But by then, price has already blown past resistance, leaving a trail of liquidated traders behind.

The chart above shows the direct application of our SVP indicator on Vanguard VOO, dated March 3, 2025. The price dropped sharply from $541 to $535, with no significant trading volume between those levels. Eventually, the price found equilibrium around $535, where heavy trading volume stabilized it. This sharp drop is a textbook example of price moving through a low-volume node, just as SVP predicts.

This isn’t just a “breakout”—it’s a mechanical flush or pump, often misunderstood as driven by FOMO or FUD. But the truth? Most aggressive price moves aren’t emotional—they’re liquidation-driven. Price doesn’t "run" because people are buying with excitement—it runs because people are getting forcibly exited from their positions.

SVP helps you visualize exactly where these critical zones are. It doesn’t predict direction, but it shows you where imbalances are likely to occur, where liquidity is thin, and where stop loss hunts are likely to be brutal. So instead of guessing where the market might "break out," you're tracking where people are vulnerable—and that's the real game.