Double Trend Exhaustion™ Series

The Double Trend Exhaustion™ indicator is designed to identify critical turning points in market trends by capturing nuanced signals of buyer and seller exhaustion. Drawing inspiration from the DeMark Sequential framework, this advanced tool offers a sophisticated approach to timing market reversals with greater precision.

By analyzing the progression of price action and detecting periods where trends show signs of fatigue, the Double Trend Exhaustion™ indicator provides traders with deeper insights into potential inflection points. This makes it an essential instrument for those seeking to navigate complex market dynamics with confidence.

The Double Trend Exhaustion™ Premium indicator is an upgraded evolution of the original Double Trend Exhaustion™ indicator, designed to offer a more advanced perspective on market momentum and trend fatigue. Built upon the framework of Williams %R — a momentum oscillator that measures overbought and oversold conditions by comparing the current closing price to the highest and lowest points over a specified period — this indicator provides valuable insights into potential market reversals.

By integrating the concept of trend exhaustion with refined momentum analysis, the Double Trend Exhaustion™ Premium indicator enhances the ability to detect shifts in market sentiment before they become evident in price action. This upgraded version offers a powerful edge for traders seeking to navigate market volatility with greater precision and confidence.

Volatility & Volume Analysis Series

The Volume Weighted Average Price (VWAP) is often regarded as the market maker's secret weapon — a powerful tool leveraged by institutional traders to outmaneuver retail participants. By calculating the average price of an asset weighted by trading volume, VWAP reveals where the “smart money” is positioning itself throughout the trading session.

Institutions and high-frequency traders use VWAP to gauge fair value, manipulate market sentiment, and execute large orders without alarming the market. Retail traders who overlook this critical benchmark risk falling prey to these tactics. By incorporating VWAP into your strategy, you gain insight into the hidden dynamics of price action, empowering you to trade alongside the market's biggest players instead of against them.

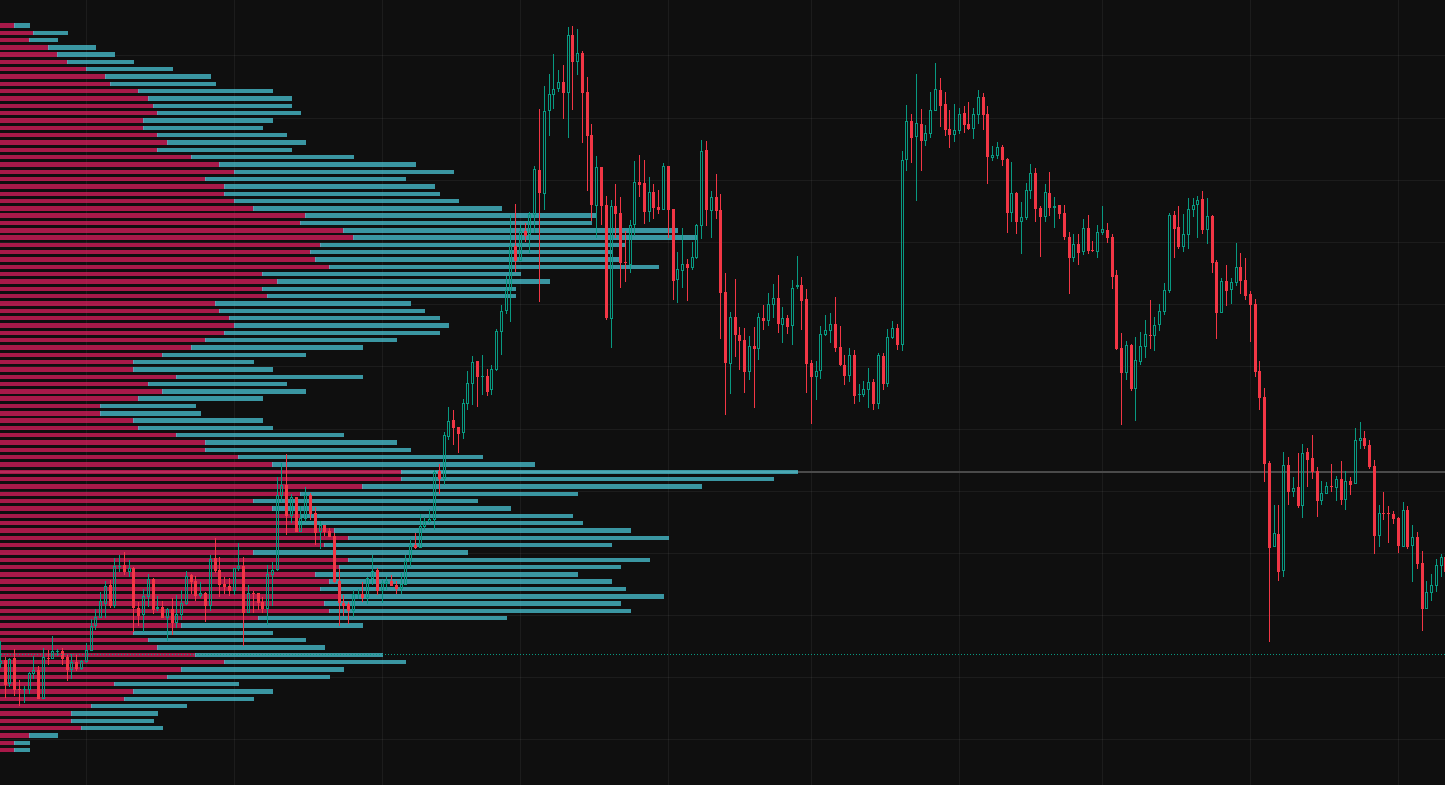

The Session Volume Profile provides access to the market's most crucial information — volume action — something that retail traders are often blind to. While traditional price action analysis relies solely on drawing lines on a price chart, it misses the most important signal: where the real trading volume is happening.

Institutions and market makers know that volume, not just price, dictates market movement. The Session Volume Profile reveals how volume is distributed across price levels, showing where the market is truly in play and where retail traders might be misled. By focusing on the hidden forces of volume, this tool gives you a powerful edge in identifying high-volume nodes (HVNs) and low-volume nodes (LVNs) — critical levels where price is likely to reverse or consolidate.

Long-Term Entry-Exit Signal Series

The Maximum Drawdown Threshold Indicator is designed to help traders identify key entry and exit points during periods of FUD (Fear, Uncertainty, and Doubt) and FOMO (Fear of Missing Out), which are often the driving forces behind volatile market movements. By analyzing market extremes, this indicator highlights critical thresholds where price action may be unsustainable, enabling traders to avoid emotional decisions and stay focused on long-term asset growth.

Whether you're looking to enter at market lows or exit at overbought conditions, the Maximum Drawdown Threshold Indicator offers a precise way to navigate through the noise of FUD and FOMO, ensuring your decisions are driven by strategy rather than short-term emotions. By using this tool, you position yourself for sustainable growth, minimizing the impact of market hysteria on your investments.