Double Trend Exhaustion™ Indicator

1. First Step: Countdown

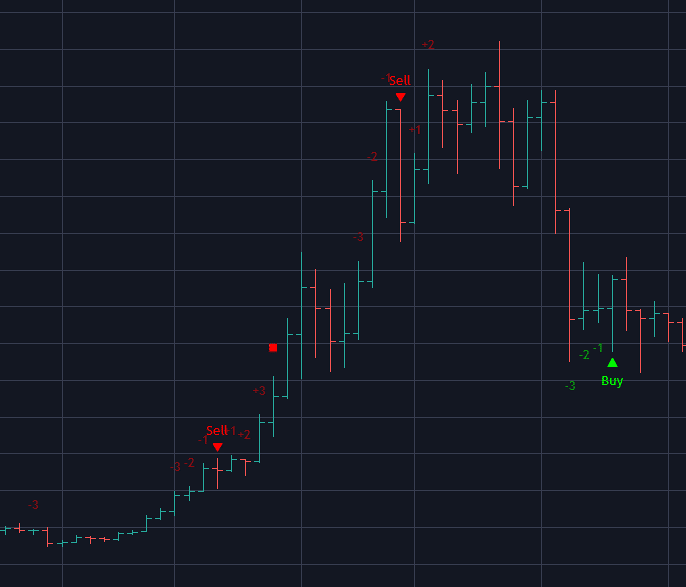

As momentum begins to build, a dynamic countdown -3, -2,

-1 starts to appear, signaling that the market is

shifting. This early-stage indicator tracks sustained

directional pressure, and as the trend intensifies over

nine consecutive periods, it reaches a critical

exhaustion point, ready to trigger a powerful reversal

signal.

As shown in the graph, the -3, -2, -1 countdown

progressively builds up, leading to a signal trigger as

momentum exhaustion is confirmed.

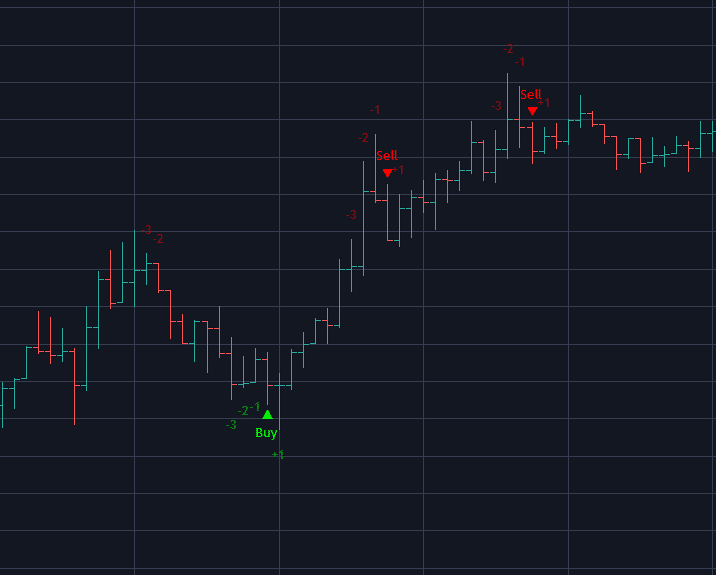

2. Second Step: Setup

When a buy or sell signal is triggered, evaluate if the

corresponding candlestick breaks through the -3 and -2

levels. If it does, the setup aligns with optimal trend

exhaustion parameters, signaling a high-probability

reversal. If not, the market may sustain its directional

momentum, indicating the possibility of continued trend

progression before a potential reversal.

As demonstrated in the graph, this represents an optimal

setup, where the candlestick breaks through the -3 and

-2 levels, confirming a high-probability reversal under

current market conditions.

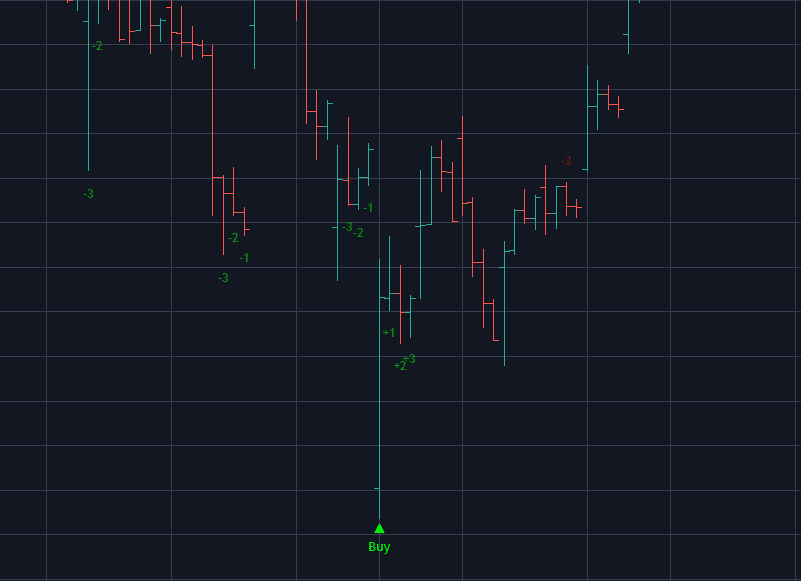

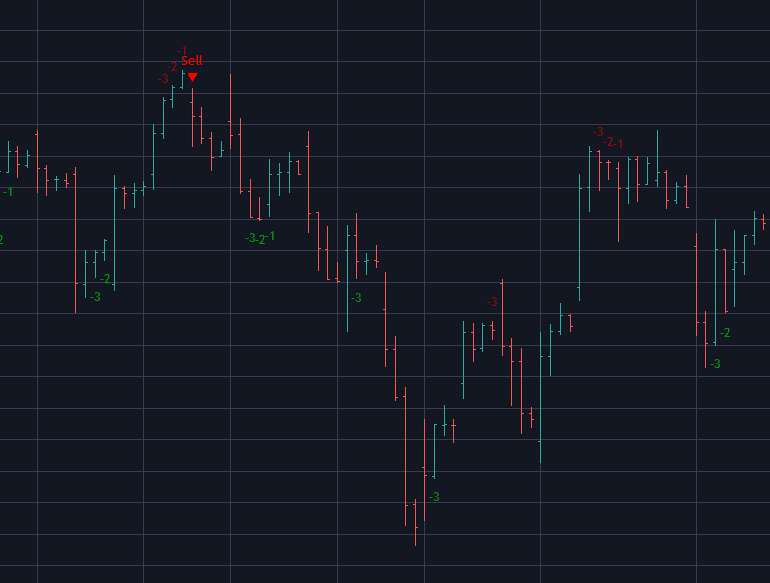

3. Third Step: Monitor

The third step involves validating the trend reversal

signal by analyzing the three subsequent candlesticks.

If +1, +2, or +3 appear, it signifies residual momentum

persistence, suggesting the trend may extend before

exhaustion. However, if no continuation markers emerge,

it confirms a definitive momentum shift, reinforcing the

reversal signal with high statistical confidence.

The graph illustrates a sell signal followed by the

absence of +1, +2, or +3, confirming an immediate trend

reversal upon signal activation.

4. "Double" Trend Exhaustion

Sometimes, the trend persists despite a signal,

especially in high-volatility, emotion-driven markets

like crypto. To counter this, a small square appears

after +1, +2, +3, marking a chase-back phase. The

counter then continues, and if the trend sustains for

2×9 = 18 consecutive periods, the reversal signal

re-triggers. Hence, the name Double Trend Exhaustion.

The graph shows Bitcoin during its 2021 bull cycle on

the weekly timeframe. As seen, the trend wasn’t

exhausted after the first signal due to hyped-up FOMO

emotions, triggering the chase-back fail-safe. The trend

was “double” exhausted after 18 consecutive weeks,

confirming the final reversal.